Adam Cockerham Chartered Financial Planner

William Dixon & Associates Ltd

Book a fee free initial consultation with no obligation

Down to earth, friendly and jargon free session where you control the pace. Published Author with book release coming summer 2026.

I am a Chartered Financial Planner working under William Dixon & Associates Ltd. William Dixon & Associates Ltd is an appointed representative of The Openwork Partnership, a trading style of Openwork Limited which is authorised and regulated by the Financial Conduct Authority.

Services

Having advised clients on their protection needs and subsequently helped them with numerous claims, I am passionate about ensuring you and your loved ones are protected from loss of life, critical illness or long term sickness.

Whether you’re just starting a long term savings plan, or need existing assets reviewed, I am here to ensure you are making the most of your financial situation.

Helping your business plan its finances tax efficiently, protecting shareholders from loss of a business partner, providing employee insurance benefits or investing corporate capital for long term growth objectives.

Are you saving up for retirement and need a plan, or are you nearing retirement and want to start accessing your provisions? Are you gradually phasing into retirement? I can help create, implement and monitor your income plan

Worried about how your estate will be treated on death? Looking to draw an income from your assets? Are you wondering how you could legitimately manage your tax liabilities? These are all questions I can help answer.

Worried about how your estate will be treated on death? Looking to draw an income from your assets? Are you wondering how you could legitimately manage your tax liabilities? These are all questions I can help answer.

The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individual circumstances and changes which cannot be foreseen.

What can you Expect?

The Client Journey

How do we start?

We can arrange a no-obligation first meeting, at no cost to you. We will discuss what it is you are trying to achieve, and what your current circumstances are. I can then tell you all about how I work and help my clients, as well as how I’m remunerated. You can then make an informed decision about whether you’d like to work with me.

How do we proceed?

We can then discuss what it is you’re trying to achieve and what your financial plans are for the future. We can get a detailed understanding of your sentiments, preferences and attitude towards risk.

How will this help me?

With a firm understanding of what your goals are, and what’s suitable for you as an individual, I’m able to go away and work on your financial plan. I will undertake a detailed appraisal of your current situation, assets and goals, and return with my advice on a suitable way forward. If you want to proceed, then I can go away and make it happen for you.

How will you help keep me on track?

I keep in very regular contact with all my clients, and conduct appraisals at least annually to ensure your plan remains fit for purpose amongst an ever-changing landscape.

Highly Qualified

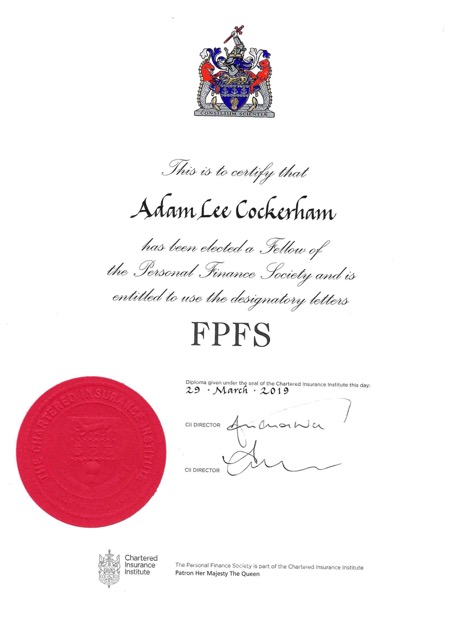

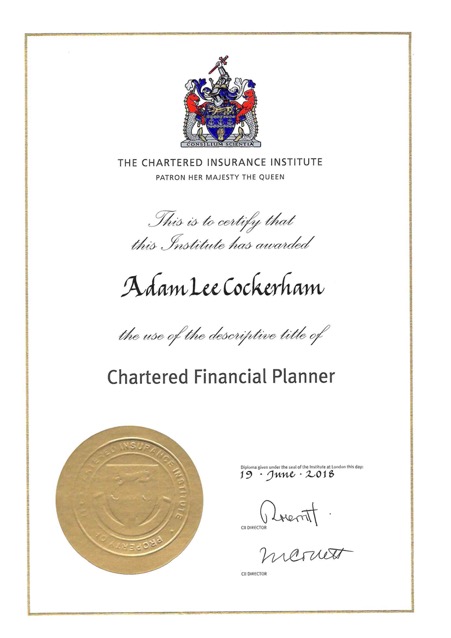

Being both a Chartered Financial Planner, and Fellow of The Personal Finance Society, I am proudly amongst the most qualified Financial Advisers in the UK. I have also completed the PIMFA ESG academy and have significant experience with Ethical and Sustainable investments. This provides peace of mind that I have gone above and beyond the minimum requirements, through many rigorous examinations and industry experience, to ensure that your financial matters are dealt with by a highly qualified professional.

Fellow of The Personal Finance Society

Financial Planner Life Podcast

Chartered Financial Planner Status – The ‘Gold Standard’ in Financial Advice.

Reviews

Nothing is more valuable to me than the satisfaction of my clients, and the relationships we build. The fact that my clients are pleased with my work and are happy to leave me reviews, and refer their friends and family to me is the biggest reward of all.

Please visit my Google listing to read some testimonials from people I’ve worked with.

Post List #1

According to a survey by Lloyds Bank, 45 per cent of empty nesters have no plans to downsize, despite the potential windfall moving to a…

Interesting theory in the Investors Chronicle. It argues that thematic portfolio diversity (investing across themes) can be just as, if not more, important during times…

Business Protection is a crucial element in a company’s financial future, but how many have cover in place? According to a study from Legal &…

Financial wellbeing is an important factor when it comes to being able to enjoy life. While we’re earning, it’s possible to secure the living standards…

How many times have you heard the phrase “It won’t happen to me” when it comes to the chances of suffering a serious illness? Unfortunately,…

Let’s be honest. Seeking advice on how to look after your money may not be as fun as the immediate thrill of spending it, but…