At 12.30pm today, Chancellor of the Exchequer Jeremy Hunt announced the UK Spring Budget, as well as the economic and fiscal forecast by the Office of Budget Responsibility.

These legislative announcements are game-changers for Britain’s economy, and Hunt’s announcements included a number of sweeping changes that could potentially affect the personal finances of everyone living and working in the United Kingdom.

In laying out the Spring Budget, Hunt reinforced the government’s dedication to building the British economy while also helping working families.

Hunt’s last announcement, made back in November, included boosts to minimum wages, an increase in State Pension, and a reduction to the headline rate for National Insurance. As of today, the government is maintaining their low-tax strategy by decreasing National Insurance even further, alongside major initiatives aimed at helping drivers, families, those in debt, and other crucial economic groups.

So, ultimately, who wins and loses? Who will benefit? Who will miss out? We’re breaking it all down in this post.

The Winners

Employees

Perhaps the most notable development from the Spring Budget announcement was the continuing drop in the main rate of National Insurance.

Referring to the tax increases for higher-income individuals, Chancellor Hunt stated that: “because we’ve asked those with the broadest shoulders to pay a bit more, today I go further. From April 6th, employee National Insurance will be reduced by another 2p, from 10% to 8%.”This is in addition to the reductions from November’s Autumn Statement, when the rate was brought down from 12% to 10%.

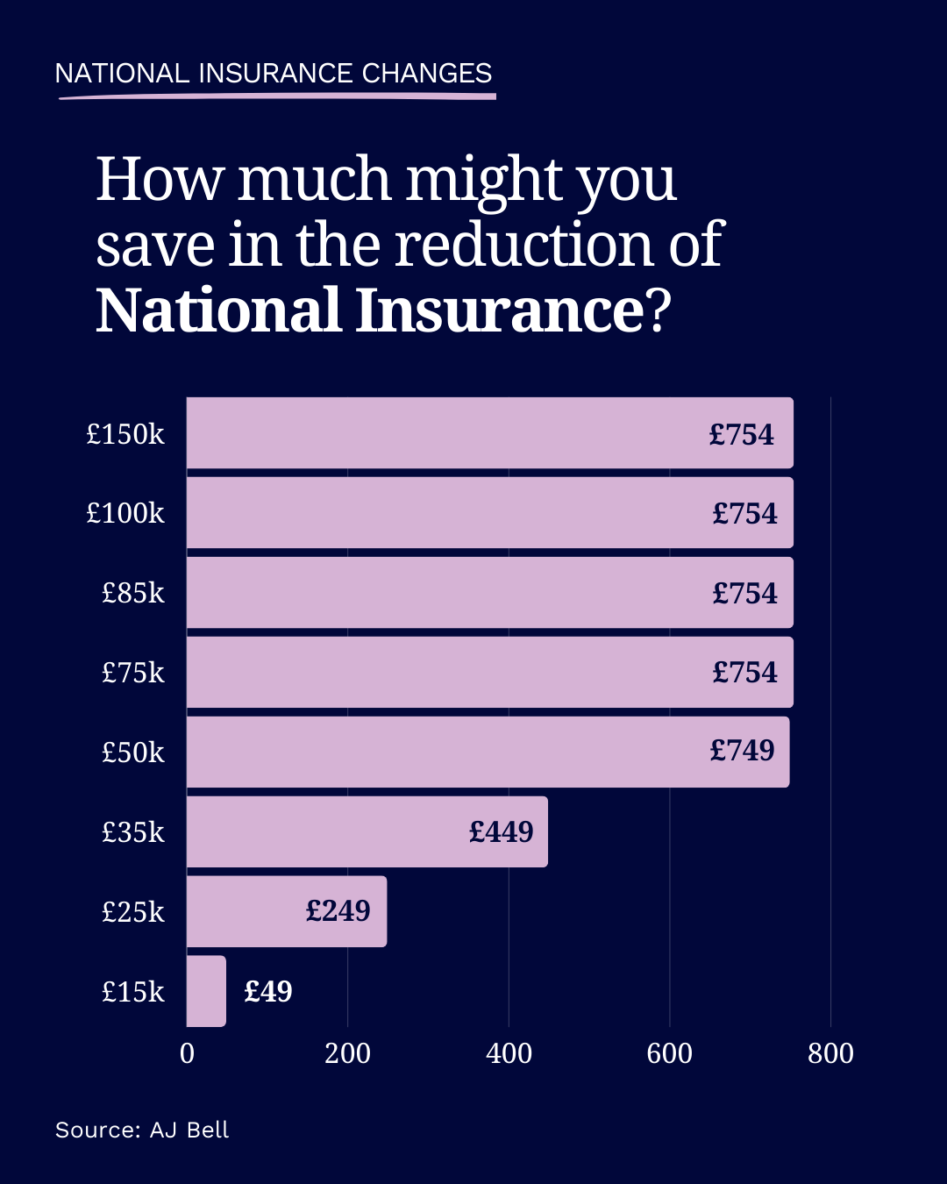

The cut is primarily aimed to benefit employees instead of employers. For example, today’s reduction would be worth around £450 for someone on a full-time salary of £35,000. However, think tanks warn that tax cuts that lack a highly specific target may do more harm than good.

The Institute for Public Policy Research (IPPR) says the cut would cost the government around £10.4 billion, and although that money would then be divided amongst taxpayers, it’s unlikely to end up in the hands of those that need it most. Since high-income individuals benefit most from National Insurance cuts, almost half of the money would go to the richest 20% of households, while only 3% would benefit the poorest 20% of families.

While a National Insurance cut would increase annual household disposable income, the IPPR warns that the negative impact on public services negates this benefit.

Families claiming child benefit

Around 500,000 families will gain almost £1,300 from an increase in the high-income threshold for child benefit. Hunt says he will change the way child benefit is paid. At present, high-income thresholds only apply to individuals as opposed to households, which is set to change.

However, as the transition would take a significant amount of time to enact, the Chancellor announced an immediate solution by increasing the higher income threshold from £50,000 to £60,000.

First-time home buyers

Hunt claimed that the government is on track to deliver over a million homes, opening up the property market and helping young people get onto the property ladder. More than £188 million has already been allocated to building new homes, and over £242 million is still to be spent on building homes across London.

In addition, Hunt stated that a higher rate of property capital gains tax is to be reduced from 28% to 24%, in a bid to increase revenues by increasing the rate of transactions.

Drivers

Fuel duty has been frozen at 52.95 pence per litre since 2011. When the Ukraine War threatened to send prices skyrocketing, a temporary 5-pence reduction to fuel duty was introduced in 2022 to balance things out.

That reduction was extended in 2023. But it has now been extended yet again by Jeremy Hunt in today’s budget announcement, preventing a 13% increase in fuel duty according to the chancellor. Scrapping the increase could cost the government around £2 billion, according to independent think tank Resolution Foundation. While obviously benefiting drivers and the UK industry in general, the plan could have notable climate consequences.

Arts, the media, and the film industry

To help maintain creative sector growth in the UK, the Chancellor has announced a wave of tax relief measures for the British film industry. For example, the rate of tax credits for visual effects studios will be increased, and a 40% tax relief on gross business rates for eligible film studios in England until 2034 was announced. Additionally, the budget included a new tax credit for UK independent films made with a budget under £15 million.

Hunt also announced £26 million in maintenance funding to the National Theatre, and stated that the tax relief for theatres will be made permanent. The relief rate now sits at 45% for touring and orchestral productions, and at 40% for non-touring productions.

Households on universal credit

The Chancellor also announced plans to assist households currently living on universal credit, by making loans easier to repay.

Hunt stated: “Nearly one million households on Universal Credit take out budgeting advance loans to pay for more expensive emergencies like boiler repairs or help getting a job. To help make such loans more affordable, I have today decided to increase the repayment period for new loans from 12 months to 24 months.”

Hunt also announced that he would also abolish the £90 Debt Relief Order charge, and extend the Household Support Fund — aimed at supporting local councils in helping families with food banks and vouchers — for an additional six months.

The Losers

Holiday home landlords

The chancellor claimed that he intends to scrap tax breaks that make it more profitable for second homeowners to let out their properties to vacationers, rather than those who let their properties to long-term tenants. As such, the government is set to abolish the furnished holiday lettings regime.

Vapers and Smokers

The Chancellor also announced a new tax on smoke-free heated tobacco products — set to take effect from October 2026 — following on from the government’s proposed vaping crackdown announced in the autumn. Hunt also announced a one-off increase in tobacco duty. This means that taxes on tobacco products will rise further, making the habit far more expensive.

Oil and Gas Companies

Chancellor Hunt has announced an extension of the windfall tax on oil and gas companies. This means the government will apply the tax for another year beyond the previous end date. Instead of concluding in March 2028, it will continue on into March 2029, raising £1.5 billion.

The windfall tax (more accurately known as the 2022 Energy Profits Levy) is a response to the soaring profits oil and gas companies began making after the combined impact of the lifting of COVID-19 restrictions and price increases due to Russia’s war in Ukraine. The 35% tax (originally 25% but raised in January 2023) applies to any profits made from the extraction of UK oil and gas.

Non-Domiciled Residents

The Chancellor also announced that rules over the taxation of non-dom residents — those who live in the UK but keep their permanent, registered place of residence abroad — are set to change. Hunt stated that the existing system will be replaced by a: “modern, simpler and fairer” one, as of April 2025. From then on, non-domiciled residents living in the UK will face the same taxes as other UK residents after four years.

What’s Next?

As you can see, the 2024 Spring Budget statement has unveiled a number of key initiatives aimed at growing the economy, supporting business, and boosting industry across the nation.

It’s clear that these new initiatives will have a major impact on the finances of British people, and businesses operating in the country. It’s vital, therefore, to seek sound financial advice based on the adaptations laid out by the budget. Indeed, it can be tricky to understand exactly how the Spring budget will affect you or your enterprise without consulting qualified financial advisors first.

So, if you want more information on how the Autumn budget could affect your finances, don’t hesitate to get in touch now.

The value of investments and any income from them can fall as well as rise, so you may not get back the original amount invested.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individual circumstances and changes which cannot be foreseen.

Approved by The Openwork Partnership on 06/03/2024