Adam Cockerham Chartered Financial Planner

William Dixon & Associates Ltd

Book a fee free initial consultation with no obligation

Down to earth, friendly and jargon free session where you control the pace

Services

Having advised clients on their protection needs and subsequently helped them with numerous claims, I am passionate about ensuring you and your loved ones are protected from loss of life, critical illness or long term sickness.

Whether you’re just starting a long term savings plan, or need existing assets reviewed, I am here to ensure you are making the most of your financial situation.

Helping your business plan its finances tax efficiently, protecting shareholders from loss of a business partner, providing employee insurance benefits or investing corporate capital for long term growth objectives.

Are you saving up for retirement and need a plan, or are you nearing retirement and want to start accessing your provisions? Are you gradually phasing into retirement? I can help create, implement and monitor your income plan

Worried about how your estate will be treated on death? Looking to draw an income from your assets? Are you wondering how you could legitimately manage your tax liabilities? These are all questions I can help answer.

Worried about how your estate will be treated on death? Looking to draw an income from your assets? Are you wondering how you could legitimately manage your tax liabilities? These are all questions I can help answer.

The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individual circumstances and changes which cannot be foreseen.

What can you Expect?

The Client Journey

How do we start?

We can arrange a no-obligation first meeting, at no cost to you. We will discuss what it is you are trying to achieve, and what your current circumstances are. I can then tell you all about how I work and help my clients, as well as how I’m remunerated. You can then make an informed decision about whether you’d like to work with me.

How do we proceed?

We can then discuss what it is you’re trying to achieve and what your financial plans are for the future. We can get a detailed understanding of your sentiments, preferences and attitude towards risk.

How will this help me?

With a firm understanding of what your goals are, and what’s suitable for you as an individual, I’m able to go away and work on your financial plan. I will undertake a detailed appraisal of your current situation, assets and goals, and return with my advice on a suitable way forward. If you want to proceed, then I can go away and make it happen for you.

How will you help keep me on track?

I keep in very regular contact with all my clients, and conduct appraisals at least annually to ensure your plan remains fit for purpose amongst an ever-changing landscape.

Highly Qualified

Being both a Chartered Financial Planner, and Fellow of The Personal Finance Society, I am proudly amongst the most qualified Financial Advisers in the UK. I have also completed the PIMFA ESG academy and have significant experience with Ethical and Sustainable investments. This provides peace of mind that I have gone above and beyond the minimum requirements, through many rigorous examinations and industry experience, to ensure that your financial matters are dealt with by a highly qualified professional.

Fellow of The Personal Finance Society

Financial Planner Life Podcast

Chartered Financial Planner Status – The ‘Gold Standard’ in Financial Advice.

Reviews

Nothing is more valuable to me than the satisfaction of my clients, and the relationships we build. The fact that my clients are pleased with my work and are happy to leave me reviews, and refer their friends and family to me is the biggest reward of all.

Please visit my Google listing to read some testimonials from people I’ve worked with.

Post List #1

The effect of psychology on investors You should base financial decisions on logic and facts. But psychology can have a much larger effect than you…

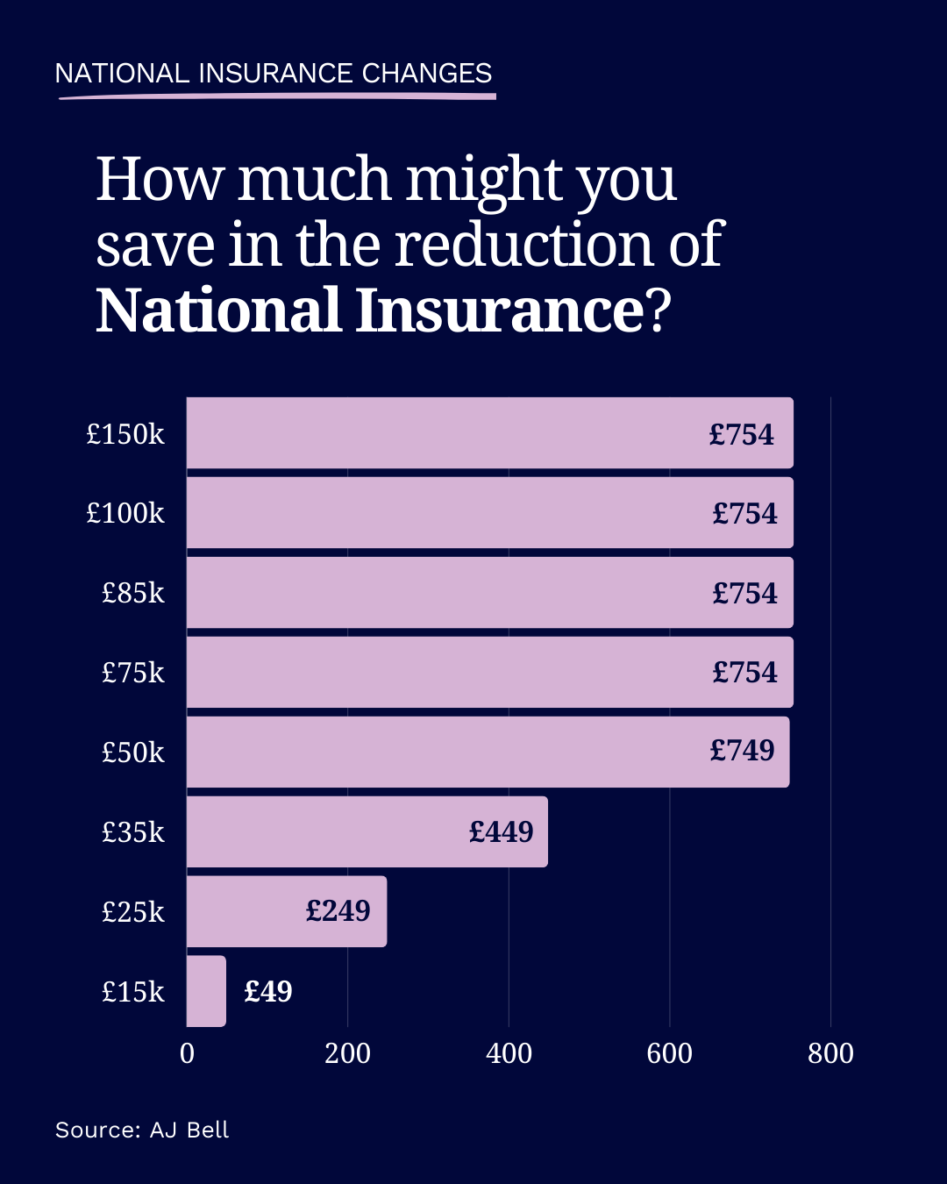

At 12.30pm today, Chancellor of the Exchequer Jeremy Hunt announced the UK Spring Budget, as well as the economic and fiscal forecast by the Office…

As a parent, you want to do everything you can to ensure that your children have a bright and secure future. One way to do…

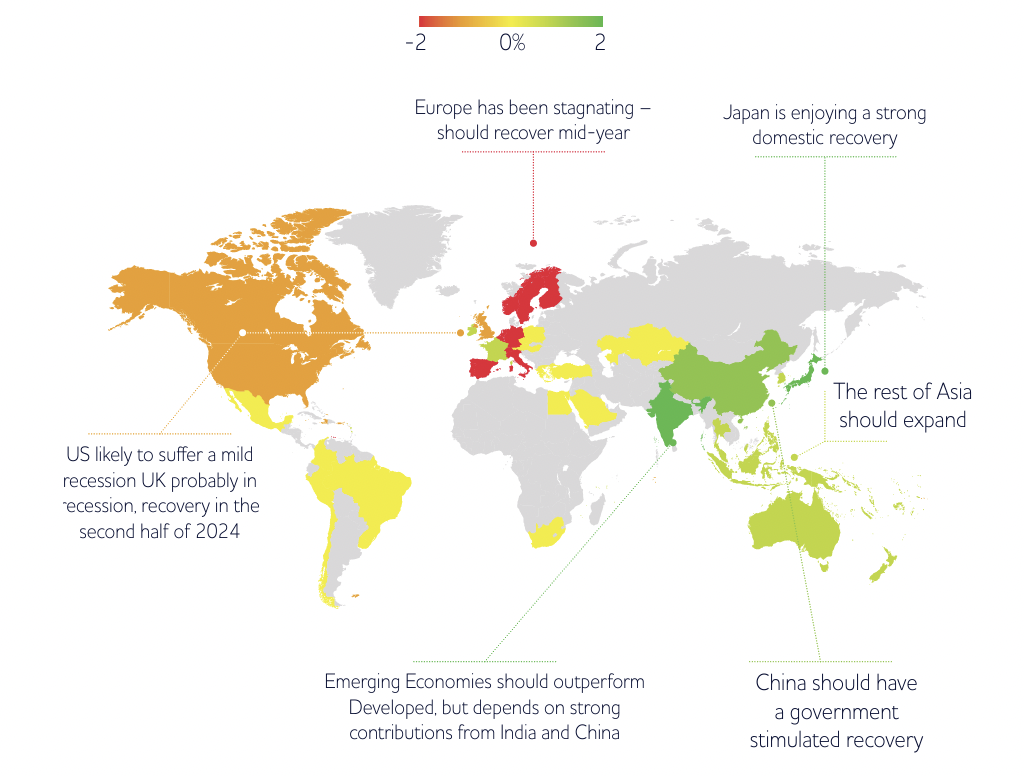

Please click here to see the 2024 investment outlook from OMNIS Investments.

In this guide, we explore saving and investing. Starting with the main differences between the two approaches to help you work out which route is…

Did you know that tax breaks could help boost your salary, savings and investments? It’s easy to miss out on their full benefits as tax…