Employer pension contributions are one of the most tax-efficient ways for a business to remunerate their key employees.

In theory, an employer can pay any amount of pension contribution to a registered pension scheme in respect of one of their employees or an ex-employee, regardless of their salary.

For tax relief to be given on employer contributions, they need to be deducted as an expense in calculating the profits of a trade, profession or investment business.

In most cases, this will not be a problem as pension contributions often are a central part of any employee reward package, and staff costs are perhaps the most genuine trade expense.

Other components such as salary and bonuses are similarly deductible from profit. However, what sets employer contributions apart from cash rewards is their exemption from employer NICs.

There is no liability to income tax as a benefit in kind for the employee if the employer pays the contributions into a registered pension scheme.

However, an employer’s pension contribution will be assessed against the individual’s annual pension allowance, money purchase annual allowance (MPAA) and tapered annual allowance.

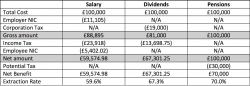

Contributions over the employee’s relevant allowance may result in an annual allowance charge. The following example shows the tax impact of an employer paying an employee in salary, dividends and pension contribution.

Julie owns a small business and wishes to pay herself £100,000 from the company.

To keep things as simple as possible she initially wants to look at the effect of paying the full amount as salary, dividends or an employer pension contribution.

Please note there are a number of assumptions in each case: the salary column assumes Julie has no other income, so has her full personal allowance available; the dividend column assumes that she can pay herself this amount in dividends under HMRC rules; and the pension column assumes that she has sufficient annual allowance available to cover the full contribution and that she will be a higher rate taxpayer in retirement.

As you can see, employer contributions can be a tax-efficient strategy. However, it is important to consider the employee’s annual allowance, as well as the fact that the pension plan cannot be accessed before age 55.