US Election 2020

The office of US President carries huge influence all over the world and, as a result, the way the American electorate votes on 3 November will undoubtedly impact financial markets across the globe. US elections are always occasions of great political theatre but the 2020 campaign, played out with the backdrop of a global pandemic, has very much raised the bar. However, the outcome will determine the future path of the world’s largest economy for the next four years and that prospect inevitably leads to considerable speculation about what victory for each of the principal candidates might mean for the markets.

‘America First’

Four years ago, Donald J. Trump was elected the 45th US President riding on one simple slogan: ‘Make America Great Again’. His 2020 pitch is very much a continuation of his ‘America First’ principles, with Trump still vowing to bring jobs and manufacturing back to the US, protect US trade interests and continue his promotion of a hard-line immigration stance, including expansion of a US-Mexico border wall.

‘Build Back Better’

When Democratic Party nominee Joe Biden formally announced his candidacy, he stated two things that he stood for: workers who ‘built this country’ and values that can bridge its divisions. His economic proposals, dubbed a ‘Build Back Better’ plan, would see a large rise in infrastructure spending; while restoring healthcare rights, environmental protections and international alliances are among Biden’s other top priorities.

Who will triumph?

Statistically speaking, the weight of history is strongly in favour of the incumbent when it comes to US presidential elections – since 1932, almost three-quarters of sitting presidents have been re-elected. However, opinion polls have consistently put Biden ahead of Trump in most key battleground states and no other incumbent has secured re-election with an approval rating as low as that endured by the current President.

The COVID factor

But these are clearly not normal times and this year’s election is racked with much greater uncertainty than usual due to coronavirus. There is certainly clear blue water in terms of the candidates’ views on COVID-19 and the response each feels government should adopt in tackling the pandemic. In addition, it remains to be seen what impact, if any, the President actually contracting the virus and his subsequent recovery, will have on people’s ultimate voting intentions. As a result, despite the evidence from opinion polls, most pundits appear reluctant to call the election just yet.

Control of Congress

While most media attention has focused on the presidential race, US voters will also be electing new members of Congress and the ability of either candidate to enact legislation will ultimately be contingent on which party assumes control of the House of Representatives and the Senate. At the moment, Democrats control the House and Republicans the Senate and if this political gridlock persists, it would act as a restraint on any radical policy proposals put forward by either candidate. In contrast, a clean sweep for either the Republicans or Democrats would alter the political landscape significantly. With just a third of Senate seats up for grabs, the Democrats may have the tougher battle but as with the presidential battle, any outcome remains plausible.

Market impact

While the US population’s choice of Trump or Biden will inevitably affect future market direction, what that impact will be is perhaps less clear-cut and opinion is certainly divided amongst analysts. Some cite strong market growth in 2016 as evidence that a Trump victory would be best for the economy, while others suggest a Biden presidency would lead to more economic stimulus and thereby boost the markets, certainly in the short term.

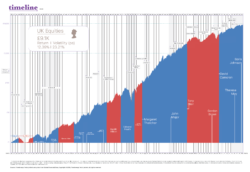

Democrats versus Republicans

A number of market commentators have also pointed to history as a potential guide to the future. Interestingly, while ‘conventional’ wisdom may suggest the US stock market should perform better under a Republican president’s ‘business-friendly’ policies, the hard facts don’t support this crude partisan caricature. Indeed, in the period since the Second World War, the evidence clearly shows that stock market indices have produced better returns under Democratic presidents than their Republican counterparts.

Better the devil you know?

Some analysts have also shown that markets tend to perform better when the same President, or a candidate from the same party, retains control of the White House. Although there is no evidence to support whether such a relationship is causal or correlational, this could imply that a ‘changing of the guard’ may dampen market prospects.

Investment cycles

Other commentators point to market cycles and their alignment with the four-year election term when assessing likely post-election economic and stock market performance. Analysis by US economist Yale Hirsch, for instance, suggests that, in the first year of any administration, economic and stock market growth is relatively weak and remains below average in year two. Year three typically produces the best results, while market performance in year four also tends to be higher than the earlier years.

The way ahead

Speculation regarding the election’s potential market impact will inevitably continue as the presidential campaign reaches a crescendo in the coming week. However, whoever ultimately takes up residency in the White House, it’s important to remember that the basic rules of successful investment won’t change. The key to investing centres on creating a balanced portfolio that is capable of adapting to changing market conditions and it’s vital not to let short-term politically-charged events alter such an approach. Adopting a consistent investment strategy and not being blown off course by short-term scenarios is most likely to stand investors in good stead over the long term.